Stay informed about the upcoming changes in Tax Collection at Source (TCS) rules, effective October 1, 2023, and their impact on international students and travelers. Learn how to navigate these regulations and make financially savvy choices for education and overseas trips.

As the calendar turns to October 1, 2023, travelers and international students are set to face changes in the tax landscape. The Tax Collection at Source (TCS) rules are about to undergo a transformation that will influence how individuals experience financing education and purchasing overseas travel packages. Virender Bisht, the co-founder and CTO at Niyo, offers insights into these new regulations.

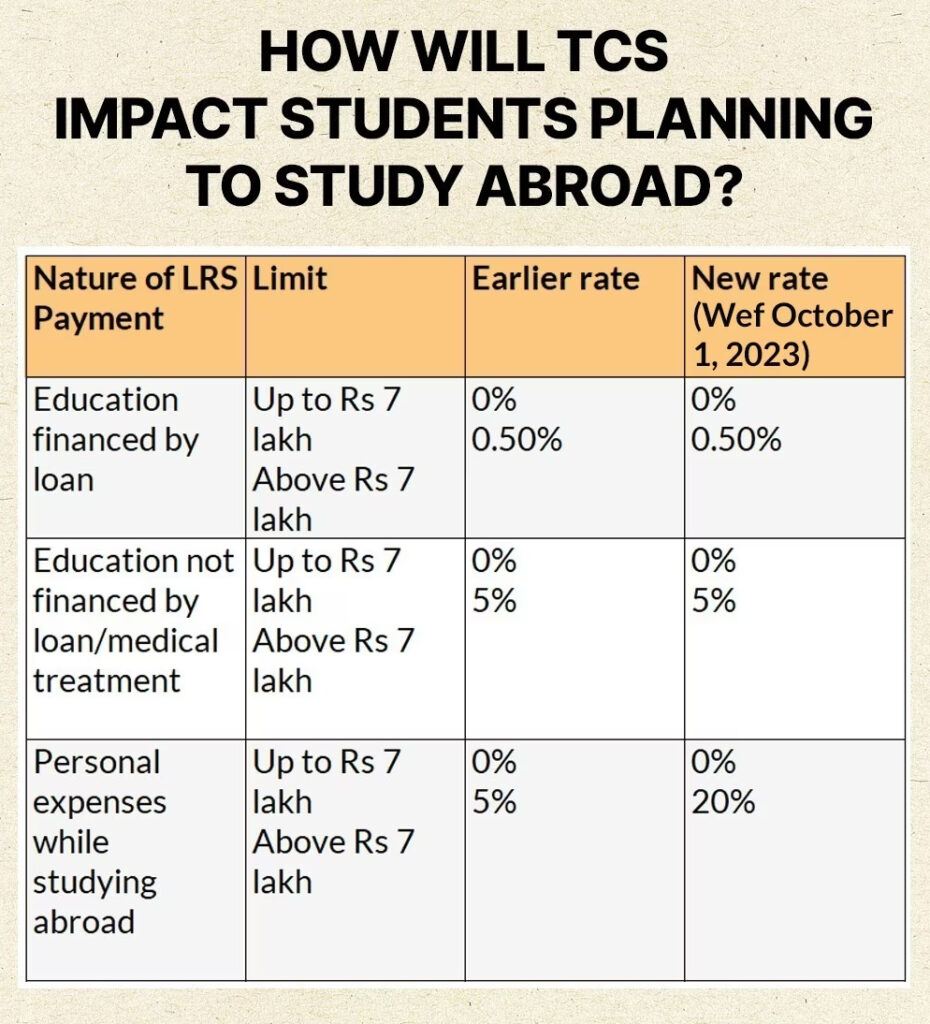

Starting October 1, 2023, revised rules governing Tax Collection at Source (TCS) will apply to the Liberalized Remittance Scheme (LRS) and the acquisition of overseas tour program packages. Notably, a significant development is the restoration of the ₹7 lakh threshold per financial year per individual for TCS across all categories of LRS payments and modes of payment, regardless of the purpose.

In an exclusive interview, Virender Bisht, co-founder and CTO at Niyo, delves into the implications of the new TCS rates and how they will impact the realms of financing education and purchasing international travel packages.

TCS rates

According to a notification issued by the Central Government on June 30, 2023, remittances for education encompass various aspects:

- Remittance for Travel: This includes purchasing tickets for students traveling between India and their country of education.

- Educational Expenses: tuition fees and other charges paid to educational institutions

- Day-to-Day Costs: Covering daily expenses such as food, accommodation, local transport, health services, and more.

While the typical remittances made by students for educational purposes are not expected to undergo significant changes post-October 1 TCS amendments, it’s worth noting that frequent remittances for daily expenses can become cumbersome and costly. To tackle this issue, many students opt for Indian international cards like the Niyo Global card, which does not subject transactions to TCS up to an aggregate of Rs. 7 lakhs in a financial year and offers zero forex markup charges.

So, how can one navigate these changes effectively, especially when pursuing international education? Given that a substantial portion of payments is processed through international portals, students are encouraged to obtain zero forex international cards that maintain the TCS exemption up to an aggregate of Rs. 7 lakhs in a financial year and do not impose forex markup charges.

For parents remitting funds to their children abroad, it’s crucial to comprehend which transactions fall under the purview of TCS. Maintaining a meticulous record of transactions, utilizing the correct LRS code, and categorizing them accurately during remittance is highly advisable. Additionally, keeping track of necessary forms and documents is essential, as TCS can be filed in the Income Tax Return (ITR).

Turning our attention to the impact of TCS on international travel packages, the following guidelines are set to come into effect on October 1, 2023:

Purchase of an Overseas Tour Package:

- Up to ₹7 lakhs per financial year (FY): 5% TCS on both debit and forex cards.

- Above ₹7 lakhs per FY: 5% TCS on both debit and forex cards.

Other International Spending Categories:

- Up to ₹7 lakhs per financial year (FY): There is no TCS on both debit and forex cards.

- Above ₹7 lakhs per FY: 20% TCS on both debit and forex cards.

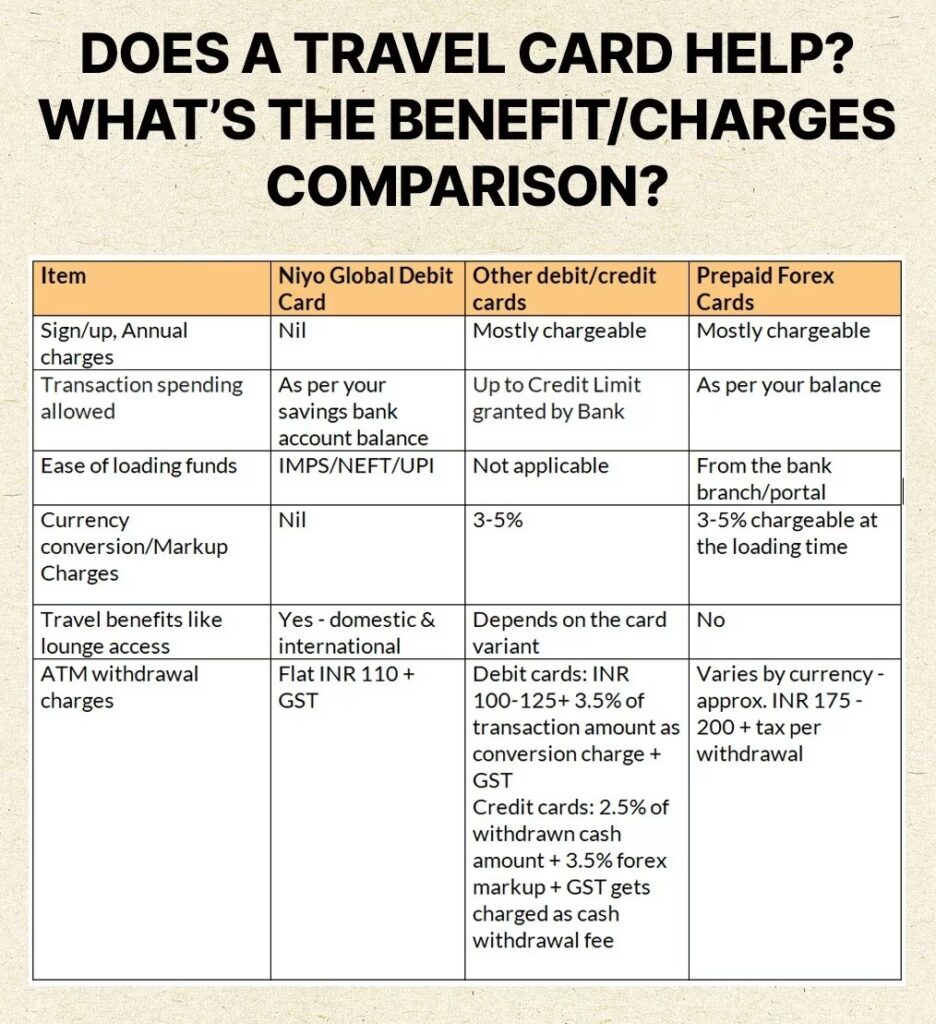

Is there a way to outsmart the TCS regulations? The optimal solution for students and leisure travelers is to opt for international cards with zero forex markup features. Such cards can help you save between 3 and 5% on each international transaction, including ATM withdrawal charges. Moreover, if two individuals with PAN cards from the same family travel together, they can split expenses and enjoy a cumulative limit of Rs. 14 lakhs, on which TCS will not be applicable.

Credit cards represent an alternative, but not all credit cards offer zero forex markup, leading to annual card charges, forex markup fees, and 36% interest on international ATM withdrawals. Although credit cards are exempt from the Liberalized Remittance Scheme (LRS), lacking a card with zero forex markup can significantly increase your overall expenses. Furthermore, obtaining a credit card is not universally accessible, and each application leads to a credit bureau score check, potentially impacting your credit score negatively.

In the case of prepaid forex cards, a 20% TCS is levied. The changes in TCS rules, effective October 1, 2023, have substantial implications for international students and travelers. Choosing the right financial instruments, such as zero forex international cards, can be a prudent step to mitigate the impact of these regulations and ensure smoother financial transactions during your international endeavors

also read Byju’s

[…] also read TCS […]

[…] also read TCS Rules […]