The Reserve Bank of India (RBI) urges Indian banks to prioritize interbank lending over depositing surplus funds, aiming to enhance liquidity and foster collaboration within the banking sector. Learn about RBI Governor Shaktikanta Das’s insights on liquidity distribution and the potential for open market sales of government bonds to manage evolving liquidity conditions. Stay informed about the latest developments in India’s banking landscape.

In a recent monetary policy address, the Reserve Bank of India (RBI) emphasized the importance of Indian banks lending their surplus funds to fellow banks rather than passively parking their money at the central bank facility. RBI Governor Shaktikanta Das articulated this perspective, highlighting the benefits of increased interbank lending opportunities.

Governor Das emphasized, “It is desirable that banks with surplus funds explore lending opportunities in the interbank call market rather than passively parking funds in the standing deposit facility (SDF) at relatively less attractive rates.” This shift in approach encourages banks to actively participate in the interbank call market, fostering greater collaboration within the banking sector.

One of the key concerns expressed by Governor Das is the trend of banks favoring the placement of funds within the overnight SDF rather than making them available for the primary 14-day variable rate reverse repo (VRRR) operations. He stressed the importance of banks evaluating their real liquidity needs during the reserve maintenance cycle and submitting appropriate bids for the main 14-day VRRR operations.

Reserve Bank of India

Governor Das also pointed out that an increased volume of call money transactions would not only deepen the interbank money market but also reduce the reliance of some lenders on the marginal standing facility. This approach aims to create a more balanced and robust banking system.

The Indian banking system has been grappling with a liquidity deficit, mainly attributed to reduced interbank market funds, since mid-September, primarily due to tax payments. This shortage of funds has resulted in an upward pressure on money market rates, further exacerbated by the central bank’s implementation of an incremental cash reserve ratio in August.

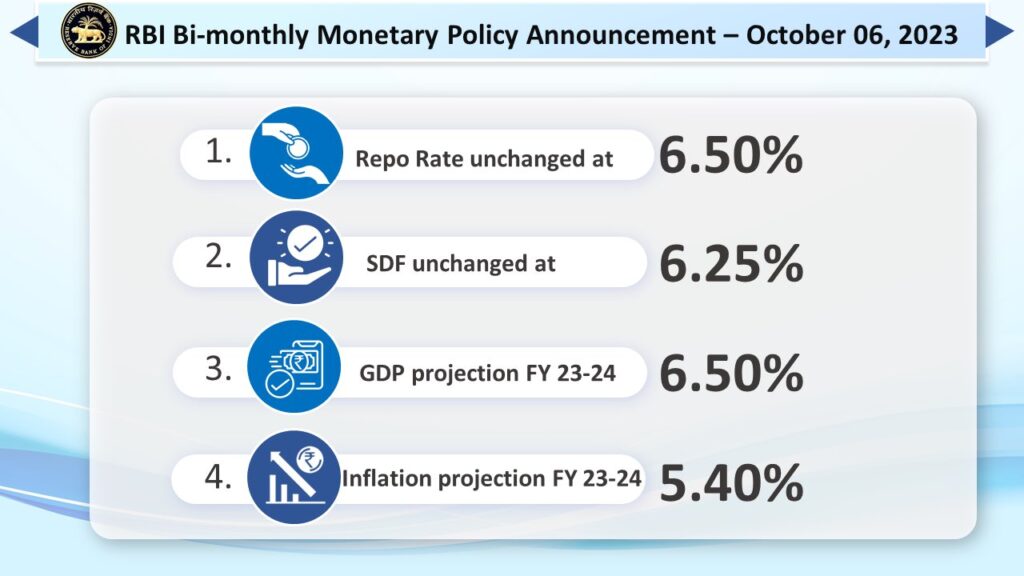

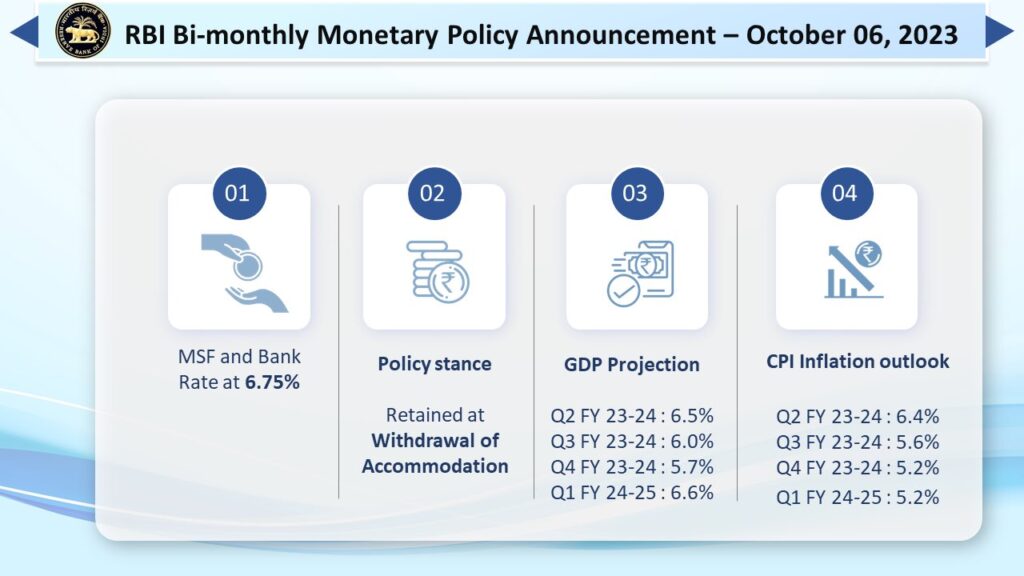

Currently, the RBI offers funds to banks at a repo rate of 6.50%, while banks can also access funds from the Marginal Standing Facility (MSF) at a rate of 6.75% and park their money with the central bank using the SDF at a 6.25% rate.

Governor Das highlighted the skewed distribution of liquidity in the banking system. Banks have been parking substantial amounts, ranging from 500 billion to one trillion rupees, with the RBI under the SDF. Simultaneously, borrowing through the marginal standing facility reached a record high of nearly two trillion rupees in September.

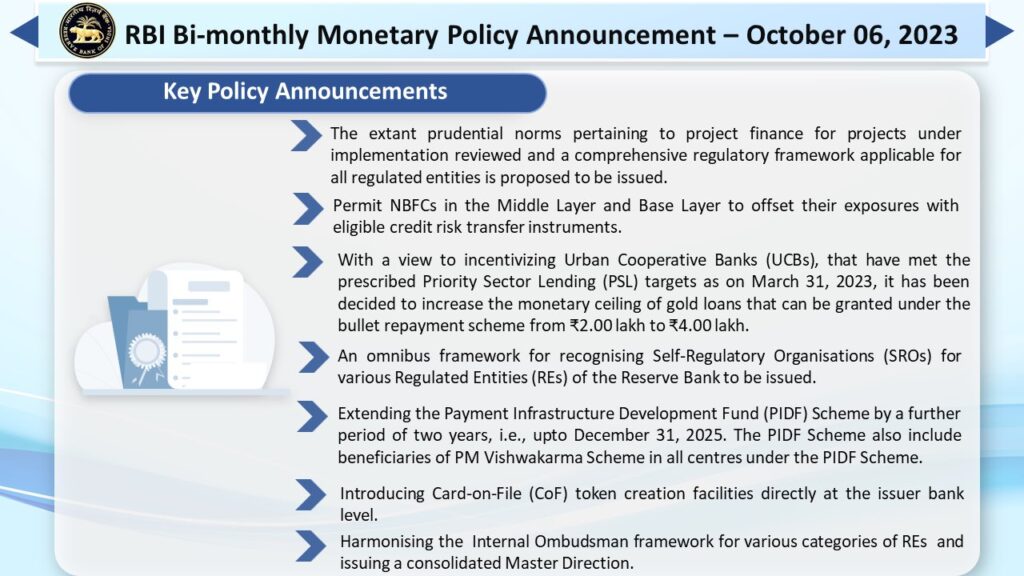

To address these liquidity challenges, Governor Das indicated that the RBI might need to consider open market sales of government bonds in the future. He stated, “While remaining nimble, we may have to consider open market operations (OMO) sales to manage liquidity, consistent with the stance of monetary policy.” The timing and quantum of these bond sales would be contingent on evolving liquidity conditions.

In the past four weeks leading up to September 22, the RBI has net-sold bonds worth 71 billion rupees through operations on the bond trading platform. This proactive approach reflects the RBI’s commitment to maintaining liquidity stability in the Indian banking system.

Governor Shaktikanta Das‘s remarks underscore the RBI’s focus on encouraging interbank lending as a means to address liquidity challenges and strengthen the interbank money market. This approach seeks to promote collaboration among banks and ensure a more balanced distribution of funds within the Indian banking system.

also read Vedanta

[…] also read RBI […]