Discover why Adani Enterprises, Adani Ports, and Adani Power saw a 2% decline in stock prices today. Explore the influence of the Israel-Palestine conflict on investor sentiment and the broader market, along with the connection to Adani Group’s recent acquisition of the Port of Haifa.

Adani Group Stocks

Adani Enterprises, Adani Ports, and Adani Power:

Factors Behind the Recent Decline in Adani Shares

On a gloomy Monday for the Indian stock market, the shares of companies within the Adani Group, namely Adani Enterprises, Adani Ports, and Adani Power, witnessed a substantial dip of nearly 2%. Several factors contributed to this downward trend, which we will explore in this article.

Impact of Geopolitical Tensions:

The bearish sentiment that weighed down the Indian equity market can be partly attributed to the ongoing Israel-Palestine conflict, which has sent ripples across global financial markets. As Israel faced attacks, investor confidence took a hit, impacting various sectors, including Adani Group stocks.

Broader Market Performance:

The poor performance of Adani Group shares mirrored the broader market sentiment. The Israel-Palestine conflict, characterized by intense clashes, contributed to a significant erosion of nearly Rs 4 lakh crore from investors’ wealth on Monday. Both the benchmark indices, Sensex and Nifty, experienced a nearly 1% decline during the early morning trading session.

The Geopolitical Link:

One aspect that heightened concerns among investors was the fact that the Adani Group had previously acquired the Israeli port of Haifa earlier this year for a substantial sum of $1.2 billion. The Port of Haifa holds a significant position in Israel’s trade, ranking as the second-largest port in the country in terms of shipping containers.

The timing of these events, with the Adani Group’s recent acquisition of a key Israeli asset, brought an additional layer of attention to the stocks.

Performance of Adani Group Firms Today:

Let’s delve into how each of the Adani Group’s firms performed in today’s trading:

- Adani Enterprises: The share price of Adani Enterprises experienced a decline of 2.14%, trading at Rs 2,424.05 per share as of 10:49 am IST. Notably, the stock has witnessed a 52-week high and low of 4,189.55 and 1,017.10, respectively.

- Adani Power Ltd: Adani Power shares saw a more substantial drop of 4.47%, reaching Rs 348.60 per share at 10:51 am IST. The market capitalization of Adani Power Ltd. stood at Rs 1,34,530.03 crore at this price. Over the last six months, the stock has shown significant gains of 82.25%.

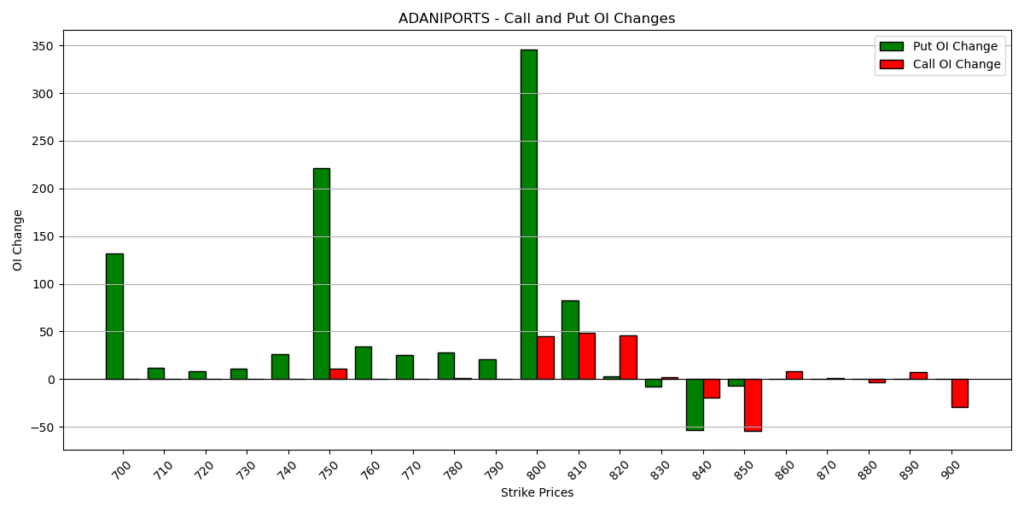

- Adani Ports and Special Economic Zone Ltd (APSEZ): APSEZ’s share price declined by 3.68%, trading at Rs 800.00 per share at 11:03 am IST. The stock has displayed a 52-week high and low of 916.00 and 394.95, respectively. In the last six months, the stock has gained 24%.

The Adani Group’s stock performance took a hit on Monday, primarily due to the prevailing bearish sentiment amid geopolitical tensions and the broader market’s underperformance. The Adani Group’s recent acquisition of the Port of Haifa, given the context of the Israel-Palestine conflict, added an interesting dimension to the decline in their stock prices.

Investors will be closely watching the developments in the region and their potential impact on the Adani Group’s investments in Israel as the situation continues to evolve.

also read Middle East Stocks

[…] also read Adani Group […]